The three “questions” of the CEO

Herbert Simon, Nobel Prize in Economics in 1978, already in 1954, inaugurating the field of Directional Control studies, defined the scope within which the discipline and practice would move for over 70 years. According to Simon, information for top management must answer three types of questions.

- Am I doing well or badly?

- Which problems should I focus on?

- Which alternative, among many, is the best?

Another management scholar, William Newman, identified three “control mechanisms” that explain well, even better, the meaning of Simon’s first two questions.

The first control mechanism, “yes-no control” (pass/fail), is the typical administrative, authorizing, bureaucratic control: a certain expense is allowed or not.

It is also attribute control or threshold level control in processes: the maximum allowed tolerance.

Neither of these is central to the CEO’s interest, so Thauma does not deal with them.

Thauma’s interest lies in the other two mechanisms: “directional control” and “post-action control” which correspond to Simon’s first two questions. In fact, these forms of control, taken together, serve to verify that:

- we are heading in the direction of the goal

- we are achieving the goal step by step.

This is “concurrent control,” control exercised while operating, simultaneously looking at the past, present, and future.

This control mechanism also responds to the need to pay attention to everything that stands between the current position and the goal. Attention is particularly given to what is less evident but could take on different dimensions in the future.

To better understand how Thauma answers these three questions, let’s examine each of them individually.

Am I doing well or badly?

Verification of goal achievement involves budget control (fixed or “rolling”) or Key Performance Indicators (KPIs). We are not so concerned with the “how” goals are decided and assigned but with the references a good goal should have to be useful to the CEO:

- The past: improvement compared to the previously achieved performance. The extent and timeframe depend on the second reference (the “standard”).

- The “standard” or “ideal” performance: the point that could (or should) be reached by removing difficulties, obstacles, solving problems, and putting in more effort.

- Finally, the external comparison, with what others, competitors, or even “neighbors” are doing, to avoid being self-referential.

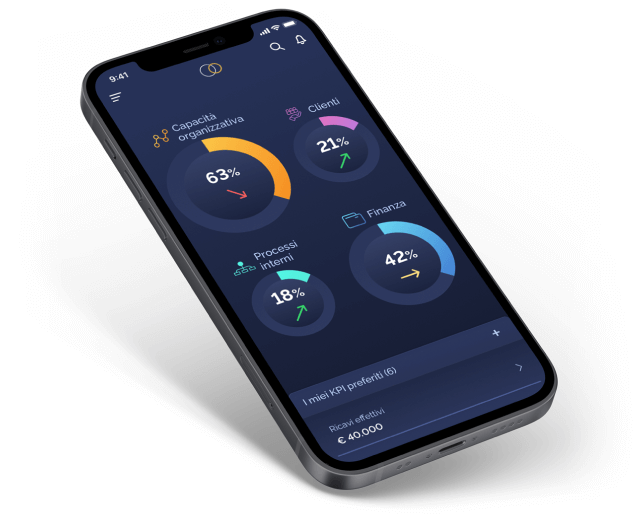

Thauma satisfies this need very well by providing all these sources of information from both internal and external perspectives. It does so by both preparing a base strategy centered on the three fundamental performances (Profit, Cash, and Growth) and allowing the CEO to set their specific strategy.

So, what are the elements and criteria that determine a high-quality control system for the CEO, ensuring a high capacity to answer the first question? According to Professor Giorgio Brunetti, the “noble father” of all Italian controllers, they include:

- Contents: which must respect the principles of:

- Relevance: Only significant information related to defined objectives and nothing else.

- Selectivity: Few truly important pieces of information.

- Reliability: Approximations are allowed as long as significance is not lost.

- Articulation: The company is unique, but understanding what happens at the highest aggregation level is not always possible. It becomes necessary to break down the overall result, adapting it to the complexity of business activities, articulating it by product/market areas and organizational responsibilities.

- Form: Information should be presented in an accessible format ready for directional use, avoiding purely “accounting” specialisms.

- Frequency and Timeliness: The effectiveness of the information system for the CEO is closely linked to its ability to reflect monitored phenomena as they unfold and with minimal delay compared to events.

We live in an era of information and cognitive overload. At all times, our minds, especially those of CEOs, are under great stress to memorize and process information.

Cognitive load can be intrinsic, depending on the natural complexity of information, or pertinence, arising from the construction of thought models that help categorize them. Then there’s a third type, “noise.”

To enhance the effectiveness of thought processes, it is absolutely necessary for working memory to focus only on fundamental activities, those generating intrinsic and pertinent loads, minimizing noise. Therefore, relevance and selectivity are critical.

Thauma has been designed to meet all these requirements. It contains a vast database of performance indicators from which each CEO can choose those of interest. It operates according to organizational lines and adopts an advanced graphical interface, using a monthly control interval in the logic of fast closing.

What problems should I pay attention to?

In reality, the CEO’s job is also, or above all, to understand if and how things are changing, grasp trends, and detect weak signals. What of what’s happening could pose a threat or an opportunity? What could go wrong if we continue to operate as usual?

There are different philosophies here: some say that the role of information systems is to process and propose scenarios to the CEO about what might happen. This essentially translates into inserting all available information into a model of logical-mathematical cause-and-effect relationships that ultimately produces a “numeric” image predicting, for example, “the market will grow/decline,” “the company will gain/lose”, etc.

Thauma does not share this approach: often, the information entered into the models is insufficient or even misleading, and the ability to model quantitative relationships between complex phenomena is limited. All this converges into producing more “pyrotechnic” than useful scenarios.

Thauma instead adopts an attitude of trust in each CEO’s ability to recognize themselves in the representation provided and identify with their own sensitivity the points and signals to pay attention to.

In 1832, von Clausewitz identified one of the qualities of a winning general (for him, it was Napoleon) in the “coup d’oeil.” The “glance” that, in predisposed individuals, can be enormously amplified by technological tools. Indeed, it’s the combined “glance plus tool” that often constitutes the condition for advancing knowledge in technical-scientific and business fields.

Thauma aims to follow and amplify this “coup d’oeil.”

Thauma relies on the qualities that every CEO generally possesses abundantly: synthesis, intuition, and the ability to make sense of events.

Synthesis: Following Chester Barnard, a great CEO of Bell Telephone in the 1930s-40s: “There are businessmen who can take a balance sheet of considerable complexity and, in a few minutes or even seconds, deduce a significant set of facts from it. These facts do not emerge from the paper, yet they strike the eye. They are found among the figures, in the part that the mind completes with years of experience and technical knowledge. This is what extracts something from a set of figures to which reason can be usefully applied.”

Intuition: Again, according to Barnard: “It seems clear to me that, whatever else may be desirable, it is certainly good to develop the efficiency of non-logical processes. How can this be done? No direct method seems usable. The task seems to be to ‘condition’ the mind and then let nature do what it can. Conditioning will consist of adequately supplying the mind and exercising non-logical faculties.”

Ability to make sense of events: The skill of recognizing an underlying structure in a complex set of unorganized information or seemingly random data. Some examples of questions/statements that demonstrate this ability and, therefore, capture ongoing trends are:

- Is it true that we earn more on certain products because we are the best at making them?

- Customers of […] don’t care about the price! They want service, and we’re not providing it. That’s why they’re leaving.

- The products in the […] lines all share one characteristic: they earn little. Why?

- On the product line […], are we earning little because we buy, produce, or sell poorly?

- What would happen if we lost the first (second) customer?

- We’ve been selling this product for 10 years, always the same. How long can we expect to continue?

- Customers of […] don’t care about this expensive optional; they want the price! It’s clear why we’re not selling.

- End customers want to be able to put on the accessory […] they want, not the standard one.

According to Gartner, “Business Activity Monitoring (BAM) describes processes and technologies that enhance ‘situation awareness’ and enable analysis of critical business performance based on real-time information. BAM is used to improve the speed and effectiveness of business management by detecting what is happening and making problems visible quickly.”

The reference to “situation awareness” is the fundamental key to understanding the mechanism that allows capturing ongoing trends.

For this reason, Thauma does not replace the CEO but provides a tool that promotes such a mental and behavioral attitude.

Situation awareness is primarily a mental condition and can be either facilitated or hindered by the available informational tools. Those who are truly concerned with “Control Systems” always have in mind the mental mechanisms needed to govern complex systems, not “Management Accounting.”

Which alternative, among many, is the best?

Making decisions requires relevant information at the appropriate level of detail for the problem at hand, and unfortunately, the needed information is rarely structured.

For example, a decision to invest in energy savings requires knowledge not only of energy consumption in various forms but also linking such consumption with environmental and production conditions. Electrical and thermal energy are consumed based on the season and therefore temperature and daylight hours, but also the operating hours and the operating regime of the plant and machinery.

In plastic injection molding, the cost of energy consumed in the lifespan of a machine (approximately 10 years) is generally higher than the purchase cost of the machine itself. Therefore, the decision to purchase is strongly influenced by operating costs. Choosing between a hydraulic, fully electric, or hybrid injection press requires knowledge of a significant amount of technical and economic data.

Data that is never available in industrial accounting systems, even the most sophisticated ones. The hydraulic machine has a higher base load (consumption when the machine is “idle”) than the electric one, but the necessary data for the decision must consider many other factors, such as the sizing of the machinery in relation to the pieces to be processed.

In conclusion, the decision-making process requires the collaboration of many different specialized skills. It is not, therefore, a “CEO’s task,” who will only verify the procedure and results.

In this sense, Thauma is not a decision-making tool because it does not believe in the possibility of being useful to the CEO by burdening them with technical-specialist functions. Thauma completely avoids incorporating information that is not strictly functional to governance activities.