The world of management consulting is not exempt from the harsh laws of marketing and must therefore periodically churn out “new theories,” “new philosophies,” “innovative tools”. In doing so, inevitably generates “trends.”

Far from being mere frivolity, lightness, and superficiality, fashion often brings about significant changes in society as a relevant element of the culture and behavior of groups of people, simultaneously creating identity/belonging and differentiation.

The same holds true for management trends: Total Quality, Lean philosophy, Six Sigma, Agile, Activity-Based Management.

Some of these trends have changed management as much as the miniskirt changed fashion. It can be hypothesized that these managerial trends are all the more pervasive and effective as they innovatively reinterpret some “fundamentals” of good business management.

What truly and essentially matters for the success of a company in the market? With a “fundamentalist” approach, there are three decisive elements:

- Producing “good products” (product understood as a good and/or service): the goodness of the entrepreneurial idea translates into a product. In the language of the Balanced Scorecard (BSC), these are the perspectives of the Customer, Processes, and Competencies/Capabilities.

- Having “satisfied customers”: perspectives of customers and processes.

- Being able to rely on the “right employees”: perspective of organizational competencies/capabilities.

These three perspectives always have a strategic significance because they express conditions and capacities that do not materialize or develop in the short term but are basic components of a lasting “entrepreneurial formula” for success.

If these conditions are satisfied, the company achieves two results:

- Some form of competitive dominance in the market or a market niche, a competitive advantage over its competitors, albeit temporary and always subject to reconsideration.

- The creation of economic value, understood as the difference between the resources produced (created and made available cash flows) and those consumed (costs and investments): expressed from the financial perspective of the BSC, profit is a result.

Obviously, this is a dynamic process that unfolds over time. Therefore, what constitutes “producing good products, having satisfied customers and the right employees” today may not meet the challenges posed by the environment and competition tomorrow, requiring more or less radical changes. If these changes do not occur, they jeopardize the very survival of the company.

Thauma is not particularly interested in distinguishing between fashion and substance in the Balanced Scorecard (BSC), assuming it is possible to do so. Thus, the question of whether the BSC is “old wine in new barrels” will remain open, and everyone can form their own opinion.

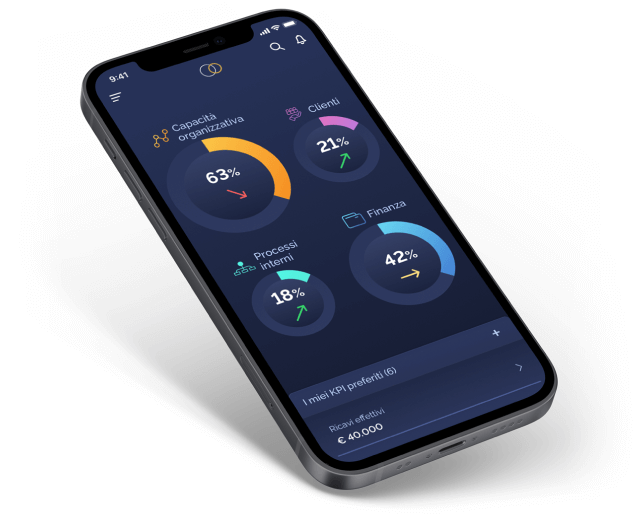

Rather, Thauma is interested in showing the CEO how it is possible to practically implement a Balanced Scorecard by making the most of the investment made in the Enterprise Resource Planning (ERP).

For this reason, Thauma’s interpretation of the BSC partially deviates from the original one proposed in 1996 by Kaplan and Norton. It provides a framework that extracts information already present in the ERP (Enterprise Resource Planning) and does not require the construction of external and parallel systems.

Below are some insights into the concrete ways of implementing the Balanced Scorecard with Thauma. The goal is not to explain the BSC in academic terms, a task for which there are excellent texts, seminars, and courses, but to help understand how Thauma transforms an everyday management tool like the ERP into a directional instrument for strategy execution.

The perspective of organizational capabilities

“To achieve our mission, how will we develop our ability to change and improve?”

This perspective provides a comprehensive overview of the resources available to the organization and how they are utilized.

It’s the perspective where Thauma deviates the most from Kaplan and Norton’s original concept. Initially defined by them as the “learning and innovation” perspective, later redefined as “learning and growth” or “organizational capabilities.” This perspective looks at:

- Human capital

- Infrastructure

- Technology

- Culture

- All other capabilities relevant to performance.

By design choice, Thauma has decided to summarize these categories into three resources (“three M’s”), corresponding to three macro-processes, each detailed into three sub-processes:

- Materials:

- Stock management

- Usability availability

- Purchases

- Man (Human Resources, internal and external service providers):

- Production capacity

- Human resources

- Internal resources

- Machine (Fixed capital, material, and immaterial):

- Production capacity

- Maintenance

- Asset management

Due to this choice, Thauma provides the CEO with all the indicators derived from a correct implementation of the ERP. However, qualitative indicators like “Employee satisfaction/motivation index” are not included for valid reasons:

- They have a poorly defined metric.

- They are manipulable.

- They require additional work.

These drawbacks go against Thauma’s philosophy. Therefore, at least in this initial phase and at the current state of average ERP implementation, Thauma has decided to focus on more established and quantitative analysis areas. In the future, even this might change.

The key idea of Thauma is that a good company performance is rooted in the equally good management of the three fundamental resources. Therefore, Thauma provides the CEO with a set of analysis areas and KPIs (Key Performance Indicators) for each resource:

- Materials: Analysis of stock, availability, and purchasing performance.

- Machine: Analysis of production capacity, operational status, maintenance, and management.

- Man: Capacity, composition, and overall workforce performance.

Thauma aims to stimulate reflection from the CEO through the analysis areas of this perspective:

- How and to what extent do the organizational capabilities available to the company contribute to effective resource management?

- How and to what extent does good resource management, through the management of fundamental operational processes, determine customer satisfaction and, consequently, financial results?

There is no one-size-fits-all answer to this question. At most, it can be generalized that:

- In a capital-intensive company, critical competencies in the acquisition, maintenance, and utilization of fixed capital will be crucial for achieving high financial returns.

- In a labor-intensive company, critical competencies in the selection, training, and organization of human capital will be decisive for achieving good economic performance.

- In a transforming/assembling company that purchases materials as a significant percentage of revenue, critical competencies in supplier selection and management, procurement and inventory planning, and manufacturing logistics will be highly relevant for economic performance impact.

Thauma introduces another aspect for the CEO’s consideration: the meaning of an objective numerical indicator related to resources is not easily interpreted in a univocal manner but requires a more qualitative reasoning.

For instance, consider the growth of the average cost per employee, which, under similar conditions, negatively impacts the Income Statement. However, if this growth is due to a workforce requalification process, perhaps with the goal of achieving higher value-added productions (which requires more than a year to be completed), the increase in the average unit cost becomes a strategic investment destined to have effects in the near or distant future.

Another example is the value of an inventory turnover indicator that increases or decreases, which cannot be unambiguously interpreted without relating it to the performance of the logistics process and customer service.

Ultimately, beyond this level proposed by Thauma, it is challenging to proceed without delving into the specifics of each individual situation. This is why it is necessary to move on to the next perspective: processes.

The Processes perspective

“To satisfy our shareholders and customers, in which Business Processes must we excel?”

The Processes perspective essentially measures productivity and the efficient use of resources.

Thauma identifies three macro-processes here, each further divided into three processes:

- Source:

- Suppliers

- Purchases

- Receipts

- Make:

- Engineering

- Planning

- Execution

- Deliver:

- Shipping

- Forward Logistics

- Customer Service

The appeal to the SCOR (Supply Chain Operations Reference) model is evident in the approach to processes and their respective areas of analysis and KPIs.

The relationship between the performance of Operations and customer satisfaction is relatively straightforward. Although it may not immediately translate into financial results of the same sign, this is the most important point on which Thauma aims to stimulate the CEO’s reflection:

How and to what extent does the improvement in the performance of operational processes translate into customer satisfaction, and how does this reflect in an improvement in financial performance?

The more complex operational processes become, the more the CEO needs tools that allow for balancing organizational efforts aimed at improving operational performance and, above all, defining the strategic priorities that determine what is most important for operations.

Take, for example, the classic “efficiency versus flexibility” problem, which can find synthesis only at the top management level, certainly not in the daily dialectic between the sales office, planning, and production.

Another example is the recurring theme of conflict between the financial director and production/purchasing, where the issue of the level of inventory must find a strategic synthesis at the CEO level.

The verification of the strategic effectiveness of pursuing certain levels of operational performance and customer satisfaction is carried out by moving on to the next perspective.

The Customers perspective

“To achieve our mission, how should we perform to meet the expectations of our customers?”

The Customer perspective measures the overall impact of the company’s actions on the market and customers.

In the Customer perspective as well, Thauma identifies three macro-processes, each further divided into three processes:

Marketing:

- Product development

- Demand Generation

- Client Management

Sales:

- Demand management

- Order generation

- Order management

Service:

- Quality management

- Reverse logistics

- Customer satisfaction

Thauma provides the CEO with a comprehensive overview of commercial performance, at the highest level of synthesis but also in-depth analysis: products, customers, markets…

The relationship between customer satisfaction, revenue growth, and improved financial performance is relatively linear, although not guaranteed a priori. In this context, the most important point on which Thauma aims to guide the CEO’s reflection is to ensure that short-term results and long-term impact are consistent.

“Selling more” is relatively easy. Every good sales professional under strong pressure to deliver results will be able to achieve them. However, sales pressure can result in the deterioration of credits, a reduction in margins, or even lead the company off its strategic trajectory: selling to the “wrong” customers instead of growing the “right” ones, damaging the growth of the latter.

Let’s assume that a company has an innovative product whose ideal distributor is capable of providing pre-sales training and post-sales support to the end user. There are companies on the market that fit this description, but they have limited commercial capabilities due to the amount of support required at the product launch.

If the manufacturing company pushes its sales force to increase turnover, it may direct them to sell to more “mass-oriented” customers who can generate numbers, at least initially, but do not align with the product’s philosophy. Therefore, after an initial sales success, they may abandon the innovative product “because it doesn’t move fast enough on the shelves.”

To ensure that financial results are as desired and sustainable in the long term, it is necessary to ensure a high degree of consistency between short-term market actions and the company’s strategy.

The Economic-Financial Perspective

“What economic-financial performance should we achieve to meet the expectations of our Shareholders?”

Finally, in the Economic-Financial Perspective, Thauma identifies three macro-processes, each subdivided into three processes, reflecting the three fundamental documents of the Balance Sheet.

Income statement:

- Revenue

- Costs

- Profitability

Balance sheet:

- Financial returns

- Leverage

- Equity

Cash flow:

- Receipts

- Payments

- Cash flows

What more can be said about these indicators that have filled volumes? Thauma aspires to offer even more insights to the CEO who truly wants to delve into the numbers. For example, it provides a detailed breakdown of receipts and payments, by Customer and Supplier or by groups of Customers/Suppliers.

Beyond the ability to impress with unusual details always at hand, Thauma’s true purpose is to constantly remind the CEO and their key collaborators of the initial assertion: profit is a result! Closing the loop, or rather, triggering a continuous virtuous cycle between organizational capabilities, processes, customer satisfaction, and economic-financial indicators.